Spacilization

PGP- FINANCE MANAGEMENT (ONLINE)

Duration

1 Years

(2 Sem/year)

Course Fees

INR Starts ₹7,500*p.m

semester

Eligibility

Above 45%

Exam Pattern

online

mic & camera

Learning

onlineLMS

LIVE & Record video

Admission

Open

dec / jul

Course Description PGP- FINANCE MANAGEMENT (ONLINE)

Online PGP in Finance Management

The Online PGP in Finance Management is a specialized and flexible program designed to provide in-depth knowledge and skills in the field of finance. Tailored for individuals seeking higher education in finance, this program offers the convenience of studying at one's own pace and from the comfort of their own environment.

The curriculum of the Online PGP in Finance Management covers a comprehensive range of subjects within finance, including financial analysis, investment management, risk assessment, and more. Students have the flexibility to choose courses based on their specific interests and career goals within the dynamic realm of finance. The program aims to impart a strong foundation in financial theory, quantitative analysis, and strategic financial decision-making, all of which are critical in today's competitive financial landscape.

Online PGP in Finance Management Overview:

The Online PGP in Finance Management stands as a comprehensive and flexible program that delves deep into various facets of finance. Crafted to provide a specialized understanding of financial principles, this program equips students with the essential skills for success in diverse finance-related roles.

The curriculum is versatile and adaptable, offering students the freedom to choose courses that focus on specific areas within finance, such as corporate finance, investment banking, financial risk management, or financial modeling. This specialization allows students to develop a profound expertise in finance and enhances their critical thinking and analytical capabilities.

Course Highlights

Why Choose Online PGP in Finance Management:

There are compelling reasons that make the Online PGP in Finance Management an excellent choice for individuals seeking a specialized and versatile degree in finance:

1. Specialized Expertise: The program provides an in-depth understanding of various finance domains, allowing students to specialize in areas like investment management, financial analysis, or risk assessment.

2. Career Relevance: With a focused curriculum in finance, graduates are well-prepared for diverse roles such as financial analysts, investment managers, risk assessors, and other finance-related positions.

3. Flexibility: The online format accommodates students' schedules, making it ideal for working professionals or individuals with other commitments who aspire to enhance their expertise in finance.

4. Strategic Decision-Making: The program emphasizes strategic financial decision-making, equipping students with the skills to navigate the complexities of financial management and contribute effectively to organizational success.

5. Networking Opportunities: Through virtual discussions, forums, and collaboration with industry professionals, the program facilitates networking opportunities within the finance community, enhancing career prospects and business connections.

Who Should Apply?

The Online PGP in Finance Management is suitable for a diverse range of individuals looking to pursue advanced education in finance with flexibility and convenience. This program is particularly ideal for:

1. Finance Enthusiasts: Individuals with a keen interest in finance and a desire to build a career in the financial sector can benefit from the specialized curriculum of the Online PGP in Finance Management. It provides the necessary knowledge and skills for success in various finance roles.

2. Working Professionals in Finance: Those already employed in finance roles who wish to enhance their qualifications or explore different areas within finance can leverage the flexibility of this program. It enables them to study at their own pace while balancing work and studies effectively.

3. Aspiring Investment Managers: Individuals interested in investment management, portfolio analysis, and financial decision-making can find the program valuable. It equips students with specialized knowledge in these areas, crucial for success in investment-related roles.

4. Individuals Seeking Financial Expertise: The program is suitable for individuals looking to develop expertise in financial management applicable to various industries. This specialized approach allows graduates to stand out in the competitive finance landscape.

When Should I Pursue an Online PGP in Finance Management:

The Online PGP in Finance Management can be pursued at any stage of your academic or professional journey, catering to individuals at different points in their careers. Whether you are a recent graduate, a seasoned finance professional, or someone seeking a career change, this program offers the flexibility to align with your needs.

- Recent Graduates: For recent graduates with a background in finance or a related field, the Online PGP in Finance Management serves as an excellent way to deepen your knowledge and kickstart your career in specialized finance roles.

- Working Professionals: For those already working in finance roles, the program provides an opportunity to enhance qualifications, acquire specialized expertise, and stay abreast of industry trends without interrupting your career trajectory.

- Career Changers: Individuals looking to switch careers and enter the finance sector can leverage the program to gain the necessary skills and knowledge for a successful transition into finance-related roles.

Key Highlights:

The Online PGP in Finance Management boasts several key highlights that make it an attractive choice for individuals seeking a specialized and flexible degree in finance:

1. Specialized Curriculum: The program offers a tailored curriculum focused on finance, covering topics such as financial analysis, investment management, risk assessment, and financial modeling.

2. Flexibility: Designed to accommodate diverse schedules, the program allows students to study at their own pace and from anywhere globally. This flexibility is particularly advantageous for working professionals or individuals with other commitments.

3. Experienced Faculty: Taught by seasoned faculty with expertise in finance, the program ensures students receive guidance and support throughout their academic journey.

4. Supportive Learning Environment: The Online PGP in Finance Management provides access to a robust online learning platform and resources. Students can engage in discussions, collaborate with peers, and access study materials conveniently.

5. Career Opportunities: Graduates of the program are well-equipped for a variety of finance-related roles, including financial analysts, investment managers, risk assessors, and other positions within the financial sector.

Course Duration:

The duration of the Online PGP in Finance Management program may vary depending on the institution and the chosen mode of study (full-time or part-time). On average, the program can be completed in one to two years of full-time study, with part-time options available for those seeking a more flexible pace.

The program is designed to provide flexibility, allowing students to study at their own pace. Some institutions may offer accelerated options or allow students to take breaks between courses if needed. The duration may also depend on the number of courses taken per semester and the student's ability to complete the required credits.

When planning to pursue the Online PGP in Finance Management program, it is crucial to consider personal commitments,

time availability, and career goals. Prospective students are encouraged to consult with the institution offering the program to gain a clear understanding of the course duration and any flexible study arrangements available.

Academic Fees:

The academic fees for the Online PGP in Finance Management program may vary based on the institution and the mode of study (full-time or part-time). Prospective students are advised to check with the specific institution for the most accurate and up-to-date information on fees.

Typically, the fees cover tuition, registration, and any additional charges for study materials or online learning platforms. Some institutions may offer financial aid or scholarships to eligible students pursuing a specialized degree in finance. It is recommended to explore these options and inquire about any available funding opportunities.

When considering academic fees, it is essential to also factor in other costs such as textbooks, technology requirements, and any additional expenses related to online learning, such as internet access or software requirements. Planning and budgeting for these costs can contribute to a smooth and successful academic journey.

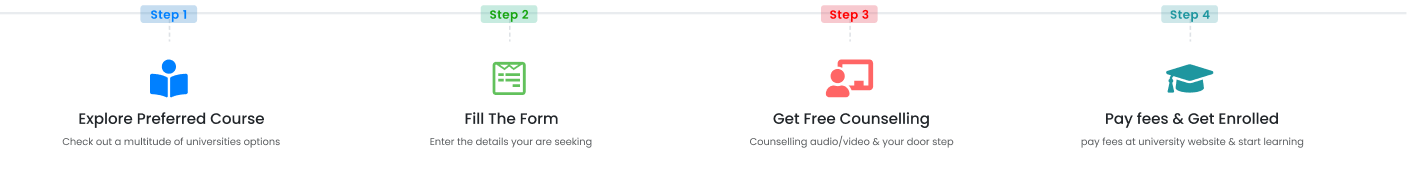

Admission Procedure:

The admission procedure for the Online PGP in Finance Management program may vary depending on the institution offering the program. However, some common steps involved in the admission process include

1. Research and Choose Institutions: Begin by researching institutions that offer the Online PGP in Finance Management program. Consider factors such as accreditation, curriculum, faculty, and student support services specific to finance.

2. Check Admission Requirements: Review the admission requirements of the institutions you are interested in. These may include educational qualifications, mathematics proficiency, language proficiency, and any additional documents or tests required for the specialized nature of the program.

3. Complete the Online Application: Once you have chosen an institution, complete the online application form for the Online PGP in Finance Management program. Provide accurate and up-to-date information, and ensure that all required documents are submitted.

4. Pay Application Fee: Some institutions may require an application fee to process your application. Pay the fee as per the instructions provided by the institution.

5. Submit Supporting Documents: Submit all the required supporting documents, such as transcripts, letters of recommendation, personal statement expressing your interest in finance, and any other documents specified by the institution.

6. Technical Requirements: Since the program is delivered online, applicants must ensure they meet the technical requirements specified by the institution.

7. Await Admission Decision: After submitting your application and supporting documents, wait for the admission decision. This may take some time, so it is advisable to apply well in advance of the program start date.

8. Accept Offer and Enroll: If you receive an offer of admission, carefully review the offer and any conditions attached. Accept the offer as per the instructions provided by the institution and complete the enrollment process.

It is important to note that the admission procedure may vary, and it is recommended to refer to the specific institution's website or contact their admissions office for detailed and accurate information.

Why Opt for Education Loan:

Considering an education loan is a strategic choice for financing your Online PGP in Finance Management. Here are compelling reasons why you might find an education loan beneficial for this specialized program:

1. Financial Support: Education loans serve as a crucial source of financial support, covering tuition fees, study materials, and other relevant expenses specific to the specialized nature of the Online PGP in Finance Management. This financial assistance is invaluable for easing the monetary burden associated with pursuing an advanced degree.

2. Flexible Repayment Structures: Education loans typically offer flexible repayment options, enabling you to repay the loan after completing your finance studies or through installment plans over a defined period. This flexibility ensures that you can effectively manage your finances, aligning with the potential career progression and income growth associated with a specialized finance degree.

3. Building Credit History: Responsible repayment of an education loan contributes positively to building a strong credit history. This can be advantageous when applying for future loans or engaging in financial transactions related to finance and business roles.

4. Uninterrupted Focus on Studies: Opting for an education loan allows you to concentrate on your finance studies without the added stress of managing immediate financial obligations. This facilitates a full commitment to the specialized coursework and analytical challenges presented by the Online PGP in Finance Management.

5. Support for Career Goals: Pursuing an Online PGP in Finance Management enhances your expertise in finance, opening doors to various career opportunities within the finance sector. An education loan provides vital financial support to invest in your education and future career, including potential participation in finance-related internships or projects.

Carefully reviewing the terms and conditions of the education loan, including interest rates, repayment options, and associated fees, is essential. Comparing different loan options and seeking financial advice ensures an informed decision tailored to financing your specialized finance degree.Is Online PGP in Finance Management Worth It?

The value of an Online PGP in Finance Management degree hinges on individual circumstances and objectives. Assess the worth of this specialized degree by considering the following factors:

1. Career Enhancement: The Online PGP in Finance Management can significantly elevate your qualifications, unlocking diverse career opportunities within the finance sector. If you aspire to advance your career or transition to finance-related roles, this degree can provide a distinct competitive advantage.

2. Personal and Professional Growth: Pursuing an Online PGP in Finance Management allows you to delve deep into finance subjects, fostering personal and intellectual growth within the financial context. If you have a passion for learning and expanding your expertise in finance, the degree proves highly rewarding.

3. Flexibility and Convenience: Online education offers the flexibility to study finance at your own pace and from any location worldwide. If you require flexibility due to work, family, or other commitments, the Online PGP in Finance Management provides the convenience needed to balance both professional and academic pursuits.

4. Specialized and Transferable Skills: The skills cultivated through the program, such as financial analysis, investment management, and strategic decision-making, are highly specialized and transferable. These skills enhance your employability and adaptability in the competitive finance landscape.

5. Networking Opportunities: Online PGP programs often facilitate networking through virtual discussions, forums, and collaborations with peers and industry professionals. Building a network within the finance community can be invaluable for future career prospects and business connections.

6. Alignment with Personal Goals: Consider your personal circumstances, financial resources, time availability, and career aspirations within the context of pursuing a specialized finance degree. If the Online PGP in Finance Management aligns with your current situation and financial goals, it can be a worthwhile investment in your future.

Ultimately, the value of an Online PGP in Finance Management degree lies in how effectively you leverage it to achieve your finance-related objectives. Careful research, choosing a reputable institution, and weighing the benefits against the costs and commitments involved are essential steps in making an informed decision.

Examination Pattern for PGP in Finance Management

Online exams for the PGP in Finance Management are designed to evaluate students' understanding of complex financial concepts and their ability to apply strategic financial principles. The examination pattern may vary across institutions, but here is a general overview of what you can expect:

1. Varied Exam Formats: Online exams for the PGP in Finance Management may include a mix of question formats, such as multiple-choice questions, case studies, quantitative problems, and essay-type questions. The varied formats aim to assess different aspects of students' knowledge and skills in finance.

2. Pre-Announced Exam Schedule: Students are typically informed in advance about the date and time window during which the online exam will be available. It is crucial to mark this schedule in your calendar and plan your study time accordingly.

3. Accessing the Exam: On the designated exam day, students will log in to the online learning platform or examination portal using their credentials. They will navigate to the specific course or exam section to access the questions. A stable internet connection and a compatible device are essential for a smooth exam experience.

4. Time Constraints: Students will have a specific duration to complete and submit their answers. The time allotted is predetermined by the instructor or university and is based on the complexity and requirements of the exam.

5. Submission Process: Students will answer the exam questions according to the provided instructions. The online platform may have features such as timers, word count tools, or submission buttons to guide students through the process. Once completed, students will submit their answers through the designated submission method.

6. Academic Integrity Measures: To maintain the integrity of the examination process, some online exams may incorporate remote proctoring or monitoring mechanisms. These tools use webcam monitoring, screen recording, or AI-based algorithms to detect any irregularities or attempts at academic dishonesty.

7. Grading and Feedback: Following the submission of exams, instructors or examiners will assess and grade the answers based on established criteria. The grading process may take some time, and students will receive their grades and feedback through the online learning platform or other communication channels specified by the institution.

It is imperative for students to thoroughly understand and adhere to the exam policies and guidelines provided by the course instructor or university. This includes technical requirements, exam format details, and any specific instructions related to online exams. Such preparation ensures a smooth and successful exam experience.

Course Curriculum

| Semester | Subjects |

| 1 | Introduction to Finance Management, Management Principles, Business Communication, Organizational Behavior |

| 2 | Financial Accounting, Financial Markets and Institutions, Corporate Finance, Research Methods in Finance Management |

| 3 | Investment Analysis and Portfolio Management, Risk Management, Financial Derivatives, Business Ethics in Finance |

| 4 | International Finance, Leadership in Finance, Project Management in Finance, Internship in Finance Management |

Duration of Specialization

1 Years

Eligibility Criteria

Requirements:

To enroll in the Online PGP in Finance Management program, applicants must meet specific requirements, which may vary depending on the institution offering the program. Common requirements include:

1. Educational Background: Applicants typically need a bachelor's degree in finance, business, economics, or a related field from a recognized institution. Some institutions may consider applicants with relevant work experience or prior learning assessments

2. Mathematics Proficiency: Given the quantitative nature of finance, applicants may be required to demonstrate proficiency in mathematics. This can be assessed through standardized tests or prior academic performance in mathematics courses

3. English Language Proficiency: As the program is conducted in English, applicants may be required to demonstrate proficiency in the English language. This can be done through standardized tests

4. Application Process: Applicants are generally required to complete an online application form and submit supporting documents, including transcripts, letters of recommendation, and a personal statement expressing their interest in finance.

5. Technical Requirements: Since the program is delivered online, applicants must have access to a reliable internet connection and a computer or device capable of running the required software for finance-related coursework.

Specific requirements may vary, so it is advisable to check the admission criteria of the institution offering the Online PGP in Finance Management.

Skills Required:

The Online PGP in Finance Management program equips students with a range of specialized skills crucial for success in various finance-related roles. Some key skills developed through the program include:

1. Financial Analysis: Students gain expertise in analyzing financial data, interpreting trends, and making informed recommendations for financial decision-making.

2. Investment Management: The program provides specialized knowledge in investment strategies, portfolio management, and risk assessment, preparing students for roles in investment management.

3. Risk Assessment: Students learn to assess financial risks, develop risk management strategies, and apply risk assessment principles to real-world scenarios.

4. Financial Modeling: The program equips students with skills in financial modeling, allowing them to create and analyze financial models to support business decisions.

5. Strategic Financial Decision-Making: Students develop the ability to make strategic financial decisions, considering long-term organizational goals and financial sustainability

6. Communication in Finance: The program emphasizes effective communication of financial concepts, strategies, and recommendations, ensuring graduates can articulate complex financial information clearly.

7. Quantitative Skills: Given the quantitative nature of finance, students enhance their quantitative skills, enabling them to analyze numerical data, perform financial calculations, and apply statistical methods.

8. Team Collaboration: Students develop teamwork and collaboration skills, essential for working effectively with diverse teams in finance-related projects.

admission procedure

Job Opportunities

Job Opportunities in Finance Management:

The specialized knowledge and skills acquired through an Online PGP in Finance Management open doors to a spectrum of lucrative job opportunities within the finance sector. Graduates are equipped with a unique set of skills that make them highly sought after by various industries. Potential job opportunities include:

1. Financial Analyst: Graduates can pursue roles as financial analysts, responsible for analyzing financial data, interpreting trends, and providing insights to support strategic financial decisions.

2. Investment Manager: The program prepares graduates for roles in investment management, where they can manage investment portfolios, assess risks, and make informed investment decisions.

3. Risk Manager: Graduates can explore positions as risk managers, specializing in identifying, assessing, and mitigating financial risks within an organization.

4. Corporate Finance Specialist: Graduates are well-suited for roles in corporate finance, involving financial planning, budgeting, and making strategic financial decisions to support overall business goals.

5. Financial Consultant: Graduates can work as financial consultants, providing expert advice to businesses or individuals on financial planning, investment strategies, and wealth management.

6. Banking and Finance Roles: Opportunities abound in the banking and finance sector, including roles such as finance manager, credit analyst, or investment banking associate.

The specialized nature of the Online PGP in Finance Management positions graduates for success in a variety of finance-related positions. It is advisable for graduates to actively engage in networking, gain relevant work experience, and stay updated with industry trends to enhance their job prospects.

Top Recruiters

Top Recruiters in Finance Management:

Graduates with an Online PGP in Finance Management are highly sought after by esteemed employers across the finance sector. Top recruiters recognize the specialized skills and knowledge acquired through this program. Here are some prominent recruiters who value graduates with a finance management background:

1. Investment Banks: Renowned investment banks seek graduates for various roles, including investment banking analysts, associates, and managers.

2. Financial Consultancies: Leading financial consultancies value graduates for their expertise in financial analysis, risk management, and strategic financial decision-making.

3. Asset Management Firms: Firms specializing in asset management are keen to recruit graduates with a finance management background for roles such as portfolio managers and investment analysts.

4. Corporate Finance Departments: Corporations across industries value finance management graduates for positions within their finance departments, including financial analysts, finance managers, and controllers

5. Insurance Companies: Insurance firms recognize the expertise of finance management graduates, making them suitable candidates for roles in risk management, actuarial analysis, and financial planning.

6. Private Equity Firms: Private equity firms seek graduates for roles involving financial analysis, due diligence, and investment management.

Active participation in networking events, internships, and professional development activities enhances visibility and attractiveness to potential employers within the finance sector.