Spacilization

PGP -DIPLOMA(BANKING AND FINANCIAL SERVICES MANAGEMENT) (ONLINE)

Duration

1 Years

(2 Sem/year)

Course Fees

INR Starts ₹2,933*p.m

semester

Eligibility

Above 45%

Exam Pattern

online

mic & camera

Learning

onlineLMS

LIVE & Record video

Admission

Open

dec / jul

Course Description PGP -DIPLOMA(BANKING AND FINANCIAL SERVICES MANAGEMENT) (ONLINE)

Online PGP Diploma in Banking and Financial Services Management:

The Online PGP Diploma in Banking and Financial Services Management offers a specialized and flexible approach to acquiring in-depth knowledge and skills in the dynamic field of banking and financial services. Tailored for individuals seeking higher education in this sector, the program allows for convenient remote learning, empowering students to study at their own pace and from the comfort of their homes.

The curriculum of the Online PGP Diploma in Banking and Financial Services Management covers a comprehensive range of subjects, including banking operations, risk management, financial analysis, investment strategies, and regulatory frameworks. Students have the flexibility to choose courses based on their interests and career goals within the specialized realm of banking and financial services. The program aims to provide a solid foundation in financial theory, quantitative analysis, and critical thinking skills, which are essential in today's complex financial landscape.

Online PGP Diploma in Banking and Financial Services Management Overview:

The Online PGP Diploma in Banking and Financial Services Management is a comprehensive and specialized program designed to equip students with in-depth knowledge of banking and financial principles. This program focuses on providing a deep understanding of banking operations, financial markets, and the regulatory landscape, preparing students for key roles in the banking and financial services industry.

The curriculum is structured to cover various aspects of banking and financial services, allowing students to specialize in areas such as retail banking, investment banking, risk management, or financial planning. This specialized approach enables students to develop a deep expertise in banking and financial services, enhancing their critical thinking and analytical abilities within this specific domain.

Course Highlights

Why Choose Online PGP Diploma in Banking and Financial Services Management:

Several reasons make the Online PGP Diploma in Banking and Financial Services Management an excellent choice for individuals seeking specialized education in this field:

1. Expertise in Banking: The program provides specialized knowledge in banking and financial services, preparing students for key roles in the banking industry.

2. In-Depth Curriculum: The curriculum delves into various aspects of banking, including banking operations, risk management, financial analysis, and regulatory frameworks, offering a comprehensive understanding of the sector.

3. Specialized Focus: Unlike general business programs, this diploma is specifically tailored for individuals interested in pursuing careers within the banking and financial services sector.

4. Career Opportunities: Graduates of the program are well-positioned for roles in banking, financial analysis, risk management, investment banking, and other specialized areas within the financial services industry.

5. Supportive Learning Environment: The program provides a supportive learning environment with access to experienced faculty and a robust online learning platform. Students can engage in discussions, collaborate with peers, and access study materials conveniently.

Who Should Apply?

The Online PGP Diploma in Banking and Financial Services Management is suitable for individuals with a specific interest in the banking and financial services sector. This program is particularly ideal for:

1. Aspiring Banking Professionals: Individuals with a keen interest in banking and a desire to build a career in this sector can benefit from the specialized curriculum of the program. It provides the necessary knowledge and skills for success in various banking roles.

2. Current Financial Services Professionals: Individuals already employed in financial services who want to enhance their qualifications or explore different areas within banking can benefit from the flexibility of the program. They can study at their own pace while balancing work and studies effectively.

3. Individuals Pursuing Finance Careers: Those interested in finance, investment, risk management, or financial planning can find the specialized knowledge provided by the program valuable. It equips students with a deep understanding of banking and financial services principles.

4. Individuals Seeking Specialized Financial Skills: The program is also suitable for individuals looking to develop specialized financial skills that can be applied within the banking industry. This focused approach allows graduates to excel in specific banking roles.

When Should I Pursue an Online PGP Diploma in Banking and Financial Services Management:

The Online PGP Diploma in Banking and Financial Services Management can be pursued at any stage of your academic or professional journey. Whether you are a recent graduate, a working professional in the financial sector, or someone looking to enhance your qualifications, the program offers the flexibility to accommodate your needs.

If you are a recent graduate with a specific interest in banking, pursuing the Online PGP Diploma in Banking and Financial Services Management can provide you with a specialized credential to kickstart your career in the banking industry.

For working professionals in the financial sector, the program offers the flexibility to study while continuing to work. It allows you to enhance your qualifications and gain specialized knowledge in banking without interrupting your career progression.

For individuals looking to transition into the banking industry or seeking to specialize in financial services, the Online PGP Diploma in Banking and Financial Services Management provides the opportunity to gain in-depth knowledge and skills specific to this sector.

Key Highlights:

The Online PGP Diploma in Banking and Financial Services Management has several key highlights that make it an attractive choice for individuals seeking specialized education in the banking sector:

1. Specialized Curriculum: The program offers a focused curriculum covering various aspects of banking and financial services, including banking operations, risk management, financial analysis, and regulatory frameworks.

2. Expert Faculty: The diploma is taught by experienced faculty who are experts in the field of banking and financial services. They provide guidance and support to students throughout their academic journey.

3. Supportive Learning Environment: Students in the program have access to a robust online learning platform and resources. They can engage in discussions, collaborate with peers, and access study materials conveniently.

4. Career Opportunities: The specialized nature of the program equips students for key roles in the banking and financial services industry. Graduates can pursue opportunities in retail banking, investment banking, risk management, financial analysis, and more.

Course Duration:

The duration of the Online PGP Diploma in Banking and Financial Services Management may vary depending on the institution and the mode of study (full-time or part-time). However, on average, the program can be completed in one to two years of full-time study or longer if pursued on a part-time basis.

The Online PGP Diploma in Banking and Financial Services Management is designed to provide flexibility to students, allowing them to study at their own pace. Some institutions may offer accelerated options or allow students to take breaks between courses if needed. The duration of the program may also depend on the number of courses taken per semester and the student's ability to complete the required credits.

It is important to consider personal commitments and time availability when planning to pursue the Online PGP Diploma in Banking and Financial Services Management. Students should consult with the institution offering the program to get a clear understanding of the course duration and any options for flexible study arrangements.

Academic Fees:

The academic fees for the Online PGP Diploma in Banking and Financial Services Management may vary depending on the institution offering the program and the mode of study (full-time or part-time). It is recommended to check with the specific institution for the most accurate and up-to-date information on fees.

The fees for the Online PGP Diploma in Banking and Financial Services Management typically include tuition fees, registration fees, and any additional charges for study materials or online learning platforms. Some institutions may offer financial aid or scholarships to eligible students pursuing a specialized diploma in banking and financial services. It is advisable to explore these options and inquire about any available funding opportunities.

When considering the academic fees for the program, it is important to also factor in other costs such as textbooks, technology requirements, and any additional expenses related to online learning, such as internet access or software requirements. Planning and budgeting for these costs can help ensure a smooth and successful academic journey.

Admission Procedure:

The admission procedure for the Online PGP Diploma in Banking and Financial Services Management may vary depending on the institution offering the program. However, some common steps involved in the admission process include:

1. Research and Choose Institutions: Start by researching institutions that offer the Online PGP Diploma in Banking and Financial Services Management. Consider factors such as accreditation, curriculum, faculty, and student support services specific to banking and financial services.

2. Check Admission Requirements: Review the admission requirements of the institutions you are interested in. These may include educational qualifications, work experience, letters of recommendation, a statement of purpose, and any additional documents specified for the specialized program.

3. Complete the Online Application: Once you have chosen an institution, complete the online application form for the Online PGP Diploma in Banking and Financial Services Management. Provide accurate and up-to-date information, and ensure that all required documents are submitted.

4. Pay Application Fee: Some institutions may require an application fee to process your application. Pay the fee as per the instructions provided by the institution.

5. Submit Supporting Documents: Submit all the required supporting documents, such as transcripts, letters of recommendation, a statement of purpose, proof of work experience, and any other documents specified by the institution.

6. Technical Requirements: Since the program is delivered online, applicants must ensure they meet the technical requirements specified by the institution.

7. Await Admission Decision: After submitting your application and supporting documents, wait for the admission decision. This may take some time, so it is advisable to apply well in advance of the program start date.

8. Accept Offer and Enroll: If you receive an offer of admission, carefully review the offer and any conditions attached. Accept the offer as per the instructions provided by the institution and complete the enrollment process.

It is important to note that the admission procedure may vary, and it is recommended to refer to the specific institution's website or contact their admissions office for detailed and accurate information.

Why Opt for Education Loan:

Considering an education loan for financing your Online PGP Diploma in Banking and Financial Services Management can be a strategic decision. Here are some compelling reasons to consider an education loan tailored to this specialized program:

1. Financial Support for Specialized Education: Education loans provide crucial financial assistance, covering tuition fees, study materials, and other expenses related to the focused curriculum of the Online PGP Diploma in Banking and Financial Services Management. This ensures that you have the necessary resources to pursue a specialized and high-quality education in the banking sector.

2. Tailored Repayment Plans: Education loans typically offer flexible repayment options, allowing you to repay the loan after completing the program or in installments over a specified period. This flexibility is especially beneficial as it aligns with the potential career advancements and increased earning potential within the specialized field of banking and financial services.

3. Establishing a Positive Credit History: Responsible repayment of an education loan contributes positively to your credit history. This can be advantageous when applying for future loans or engaging in financial transactions relevant to roles in banking and financial management.

4. Uninterrupted Focus on Studies: Opting for an education loan enables you to concentrate on your studies without immediate financial concerns. This allows you to fully immerse yourself in the specialized coursework and analytical challenges presented by the Online PGP Diploma in Banking and Financial Services Management.

5. Strategic Investment in Career Goals: Pursuing the Online PGP Diploma in Banking and Financial Services Management can significantly enhance your career prospects within the banking industry. An education loan serves as a strategic investment, facilitating your education and potential involvement in internships or projects related to banking analysis.

It is essential to carefully review the terms and conditions of the education loan, including interest rates, repayment options, and associated fees. Exploring different loan options and seeking financial advice can aid in making an informed decision specific to financing your PGP Diploma in Banking and Financial Services Management.

Is Online PGP Diploma in Banking and Financial Services Management Worth It?

The value of an Online PGP Diploma in Banking and Financial Services Management depends on individual goals and circumstances. Here are key factors to consider when evaluating if this specialized diploma is worth pursuing:

1. Enhanced Career Opportunities: The specialized nature of the Online PGP Diploma equips you with in-depth knowledge and skills relevant to the banking and financial services industry. If you seek career advancement or a transition to roles within this sector, the diploma can provide a competitive advantage.

2. Specialized Knowledge and Personal Growth: Pursuing the Online PGP Diploma allows for exploration of various aspects of banking and financial services, fostering personal growth and intellectual development within the context of the financial industry. If you have a passion for gaining specialized knowledge, this diploma can be highly rewarding.

3. Flexibility and Convenience: Online education offers the flexibility to study at your own pace and from anywhere in the world. This flexibility is advantageous for individuals with work, family, or other commitments, making the Online PGP Diploma in Banking and Financial Services Management a convenient option.

4. Transferable Skills: The skills acquired through the program, including risk management, financial analysis, and regulatory compliance, are highly transferable and applicable to various roles within the banking and financial services sector. These skills enhance employability and adaptability in the dynamic financial landscape.

5. Networking Opportunities: Online PGP programs often provide networking opportunities through virtual discussions, forums, and collaborations with industry professionals. Building a network within the banking community can be valuable for future career prospects and business connections.

6. Personal Circumstances and Aspirations: Consider your personal circumstances, financial resources, time availability, and career aspirations when deciding if the Online PGP Diploma is worth pursuing. If the program aligns with your goals and current situation, it can be a valuable investment in your career.

Ultimately, the value of the Online PGP Diploma in Banking and Financial Services Management lies in how effectively you leverage the knowledge and skills gained to achieve your career objectives. Thorough research, choosing a reputable institution, and weighing the benefits against the commitments involved are crucial in making an informed decision.

Examination Pattern for PGP Diploma in Banking and Financial Services Management:

The examination pattern for the Online PGP Diploma in Banking and Financial Services Management is designed to assess your understanding of specialized topics and your ability to apply relevant concepts. Here is a general overview of the examination pattern for this program:

1. Exam Formats: Examinations for the PGP Diploma may consist of various formats, including case studies, essay questions, practical simulations, and multiple-choice questions. The diverse formats ensure a comprehensive evaluation of your knowledge and skills in banking and financial services management.

2. Comprehensive Coverage: The examination pattern aims to cover key areas such as banking operations, risk management, financial analysis, regulatory compliance, investment strategies, and financial planning. This ensures that graduates possess a well-rounded skill set relevant to the industry.

3. Timed Assessments: Exams are conducted within specified timeframes to assess your ability to analyze and solve problems efficiently. Timed assessments also simulate real-world scenarios, preparing you for decision-making in time-sensitive situations within the banking sector.

4. Continuous Assessment: Some courses within the PGP Diploma may implement continuous assessment methods, including assignments, quizzes, and projects. This approach provides ongoing feedback and helps gauge your progress throughout the program.

5. Practical Application: Examinations may include scenarios that require practical application of knowledge acquired during the program. This could involve analyzing financial data, proposing risk mitigation strategies, or evaluating investment opportunities.

6. Online Exam Platforms: Similar to the learning format, exams are typically conducted through secure online platforms. These platforms may include features such as timed assessments, submission portals, and secure monitoring to ensure academic integrity.

7. Proctored Exams: To maintain the integrity of the examination process, some institutions may employ proctoring methods, including webcam monitoring and AI-based algorithms. Familiarizing yourself with the examination policies and guidelines is crucial for a smooth exam experience.

8. Grading and Feedback: After completing exams, instructors or examiners will review and evaluate your responses based on predetermined grading criteria. Feedback may be provided to enhance your understanding of the subject matter and improve your performance.

It is essential to acquaint yourself with the specific examination pattern outlined by the institution offering the Online PGP Diploma in Banking and Financial Services Management. Understanding the assessment methods and preparing accordingly will contribute to your success in the program and your readiness for a career in the dynamic field of banking and financial services.

Course Curriculum

| SEMESTER | SUBJECTS |

| 1 | Introduction to Banking and Financial Services, Management Principles, Financial Accounting, Business Communication |

| 2 | Banking Operations and Services, Financial Management, Marketing of Financial Services, Research Methods in Banking |

| 3 | Risk Management in Banking, Investment Banking, Strategic Management in Financial Services, Business Ethics in Finance |

| 4 | International Banking, Leadership in Financial Institutions, Project Management in Banking, Internship in Banking and Financial Services |

Duration of Specialization

1 Years

Eligibility Criteria

Requirements:

To enroll in the Online PGP Diploma in Banking and Financial Services Management, applicants must meet certain requirements. These requirements may vary depending on the institution offering the program. However, some common requirements include:

1. Bachelor's Degree or Equivalent: Applicants typically need a bachelor's degree or its equivalent in a related field, such as finance, business administration, or economics.

2. Relevant Work Experience: Some institutions may require applicants to have relevant work experience in the banking or financial services sector. This experience can be evaluated through the submission of a resume or curriculum vitae.

3. Statement of Purpose: Applicants may be required to submit a statement of purpose expressing their interest in pursuing the Online PGP Diploma in Banking and Financial Services Management. This statement should outline their career goals and how the program aligns with their aspirations.

4. Letters of Recommendation: Some institutions may request letters of recommendation from professional or academic references who can attest to the applicant's qualifications and potential for success in the program.

5. English Language Proficiency: Since the program is conducted in English, applicants may be required to demonstrate proficiency in the English language. This can be done through standardized tests.

6. Application Process: Applicants are typically required to complete an online application form and submit supporting documents, such as transcripts, letters of recommendation, a statement of purpose, and proof of English language proficiency.

It is important to note that specific requirements may vary, and it is recommended to check the admission criteria of the institution offering the Online PGP Diploma in Banking and Financial Services Management.

Skills Required:

The Online PGP Diploma in Banking and Financial Services Management equips students with a range of specialized skills essential for success in the banking and financial services industry. Some of the key skills developed through the program include:

1. Banking Operations: Students gain a deep understanding of banking operations, including account management, loan processing, and financial transactions.

2. Risk Management: The program emphasizes risk assessment and management skills, enabling students to identify and mitigate potential risks in the financial sector.

3. Financial Analysis: Students develop advanced financial analysis skills, including evaluating financial statements, assessing investment opportunities, and conducting financial research.

4. Regulatory Compliance: The program covers regulatory frameworks in the banking sector, ensuring students are well-versed in compliance requirements and industry regulations.

5. Investment Strategies: Students learn to develop and implement effective investment strategies, considering market trends, risk tolerance, and financial goals.

6. Financial Planning: The program provides skills in financial planning, allowing students to assist clients in achieving their financial objectives through strategic planning and investment advice.

7. Communication in Finance: Students develop effective communication skills specific to the financial services industry, including conveying complex financial information to clients and stakeholders.

8. Team Collaboration: Students enhance their teamwork and collaboration skills, essential for working in diverse teams within the banking and financial services sector.

9. Problem-Solving in Finance: The program enhances students' problem-solving abilities, enabling them to address complex financial challenges and propose viable solutions.

10. Critical Thinking in Finance: Students develop critical thinking skills, allowing them to analyze financial data, assess market opportunities, and make informed decisions in dynamic financial environments.

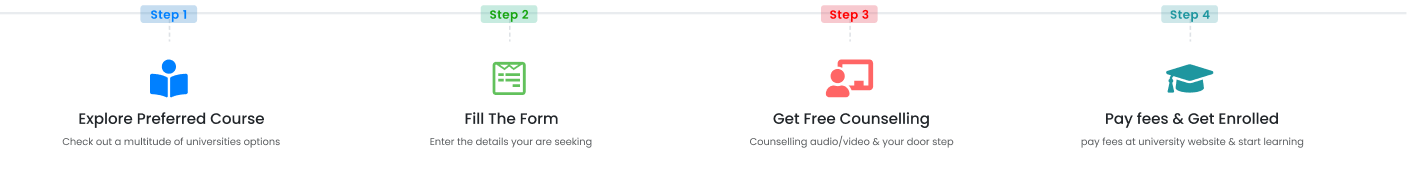

admission procedure

Job Opportunities

Job Opportunities in Banking and Financial Services Management:

Graduates of the Online PGP Diploma in Banking and Financial Services Management are well-positioned for a variety of job opportunities within the banking and financial services sector. The specialized knowledge and skills acquired during the program open doors to diverse roles, including:

1. Banking Operations Specialist: Manage and optimize day-to-day banking operations, ensuring smooth and efficient transactions.

2. Risk Management Analyst: Assess and mitigate risks associated with financial activities, ensuring compliance with regulatory requirements.

3. Financial Analyst: Analyze financial data, trends, and market conditions to provide insights for strategic decision-making.

4. Investment Banking Associate: Facilitate investment transactions, mergers, and acquisitions, and provide financial advisory services.

5. Regulatory Compliance Officer: Ensure adherence to banking regulations and compliance standards, minimizing legal and financial risks.

6. Financial Planner and Advisor: Assist clients in achieving their financial goals through strategic planning and investment advice.

7. Credit Analyst: Evaluate the creditworthiness of individuals or businesses applying for loans, managing credit risk.

8. Wealth Management Consultant: Provide personalized financial advice and investment strategies to high-net-worth clients.

9. Treasury Analyst: Manage and optimize a company's liquidity, investments, and financial risks.

10. Financial Technology (FinTech) Specialist: Explore opportunities at the intersection of finance and technology, contributing to innovative solutions.

It's important to note that job opportunities may vary based on individual qualifications, experience, and the specific focus areas within banking and financial services. Networking, gaining relevant experience, and staying informed about industry trends are essential for maximizing job prospects in this dynamic sector.

Top Recruiters

Top Recruiters in Banking and Financial Services:

Graduates of the Online PGP Diploma in Banking and Financial Services Management are sought after by top employers in the banking and financial services industry. Here are some key recruiters who value the specialized skills and knowledge gained through this program:

1. Global and National Banks: Major banks, both at the global and national levels, actively seek candidates with expertise in banking and financial services management.

2. Investment Banks: Institutions specializing in investment banking, mergers and acquisitions, and financial advisory services value graduates with a deep understanding of financial markets.

3. Financial Consultancies: Consulting firms providing financial advisory, risk management, and business strategy services often recruit individuals with specialized knowledge in financial services.

4. Asset Management Companies: Firms managing investments, mutual funds, and other financial assets seek professionals with expertise in investment strategies and portfolio management.

5. Insurance Companies: Insurance providers look for individuals with a strong background in financial services and risk management for roles in underwriting, actuarial analysis, and financial planning.

6. FinTech Companies: Financial technology firms value graduates who can bridge the gap between finance and technology, contributing to innovations in the financial services sector.

7. Regulatory Bodies: Organizations overseeing and regulating the banking and financial services industry may hire professionals with expertise in compliance, risk management, and regulatory affairs.

8. Wealth Management Firms: Companies offering wealth management services actively recruit individuals with skills in financial planning, investment advisory, and client relationship management.

9. Corporate Finance Departments: Large corporations with dedicated finance departments seek professionals with a strong foundation in banking and financial services for roles in financial analysis, budgeting, and strategic planning.

10. Government Financial Institutions: Public sector financial institutions and government bodies involved in financial oversight and regulation may have opportunities for graduates with specialized knowledge in banking.

Active networking, participation in industry events, and leveraging internship opportunities can enhance your visibility and desirability among top recruiters in the banking and financial services sector.