Spacilization

BBA- FINTECH MANAGEMENT (ONLINE)

Duration

3 Years

(2 Sem/year)

Course Fees

INR Starts ₹499*p.m

semester

Eligibility

Above 45%

Exam Pattern

online

mic & camera

Learning

onlineLMS

LIVE & Record video

Admission

Open

dec / jul

Course Description BBA- FINTECH MANAGEMENT (ONLINE)

Online BBA-Fintech Management:

The Online BBA-Fintech Management program offers a specialized and flexible approach to earning a Bachelor of Business Administration (BBA) degree with a focus on Financial Technology (Fintech). Tailored for individuals interested in the intersection of finance and technology, this program allows students to study at their own pace and from the comfort of their homes, providing the skills necessary to navigate the evolving landscape of Fintech.

Online BBA-Fintech Management Overview:

The Online BBA-Fintech Management program is designed to provide a comprehensive understanding of the dynamic field of Financial Technology. It equips students with the knowledge and skills required to thrive in roles that bridge finance and technology, such as digital banking, blockchain, data analytics, and financial innovation.

The curriculum of the Online BBA-Fintech Management program encompasses a diverse range of subjects, including financial systems, coding for finance, cybersecurity, and blockchain applications. Students have the flexibility to tailor their course selection, focusing on areas such as algorithmic trading, digital payments, or risk management within the realm of Fintech.

Course Highlights

Why Choose Online BBA-Fintech Management:

Several compelling reasons make the Online BBA-Fintech Management program an excellent choice for individuals aspiring to make an impact in the rapidly evolving Fintech industry:

1. Cutting-Edge Curriculum: The program offers a curriculum that reflects the latest trends and innovations in Fintech. Students gain insights into emerging technologies, regulatory frameworks, and industry best practices.

2. Flexibility for Tech Enthusiasts: Tailored for individuals passionate about both finance and technology, the program provides flexibility for students to delve into coding, data analytics, and other technological aspects relevant to Fintech.

3. Industry-Relevant Skills: Students acquire skills directly applicable to Fintech roles, including proficiency in blockchain technology, understanding digital currencies, and leveraging data analytics tools for financial decision-making.

4. Career Opportunities in Fintech: The specialized nature of the program prepares graduates for diverse roles within the Fintech sector. Career opportunities may include positions in digital banking, financial analysis, risk management, and blockchain development.

5. Global Perspective on Fintech: The online format enables students to explore Fintech trends globally, gaining insights into how different regions approach financial innovation and technology adoption.

Who Should Apply to Online BBA-Fintech Management:

The Online BBA-Fintech Management program is ideally suited for individuals with a specific interest in the convergence of finance and technology. It is particularly beneficial for:

1. Tech-Savvy Finance Enthusiasts: Individuals who are passionate about technology and its transformative potential in the financial sector will find the program aligns with their interests.

2. Finance Professionals Embracing Technology: Working professionals in finance who seek to enhance their skills in emerging Fintech areas, such as blockchain, digital payments, or algorithmic trading.

3. Aspiring Fintech Entrepreneurs: Those with an entrepreneurial spirit aiming to launch Fintech startups or contribute to the growth of existing Fintech ventures.

4. Recent Graduates in Finance or Technology: Graduates with a background in finance, technology, or related fields looking to specialize in Fintech and capitalize on the industry's innovation.

When Should I Pursue an Online BBA-Fintech Management:

The Online BBA-Fintech Management program is well-suited for individuals at various stages of their academic or professional journey:

1. Early-Career Professionals: Recent graduates looking to enter the Fintech industry or those with a few years of professional experience seeking to specialize in this dynamic field.

2. Mid-Career Professionals: Finance professionals or individuals working in technology-related roles who wish to pivot their careers toward Fintech and stay abreast of industry advancements.

3. Entrepreneurial Aspirants: Individuals with aspirations to start their own Fintech ventures, leveraging both financial and technological expertise.

4. Global Fintech Enthusiasts: For those interested in understanding Fintech trends and innovations globally, the online format facilitates access to a diverse range of perspectives and industry practices.

Key Highlights of Online BBA-Fintech Management:

The Online BBA-Fintech Management program stands out with key highlights tailored to the demands of the Fintech industry:

1. Cutting-Edge Fintech Curriculum: The program offers a curriculum designed in collaboration with industry experts, ensuring that students are equipped with the latest knowledge and skills demanded by the Fintech sector.

2. Flexibility for Specialization: Students have the flexibility to choose courses that align with their specific interests within Fintech, allowing for a degree of specialization in areas such as blockchain, digital banking, or data analytics.

3. Expert Faculty in Fintech: The program is taught by experienced faculty members with expertise in both finance and technology, providing valuable insights and guidance to navigate the intricacies of the Fintech landscape.

4. Global Fintech Perspectives: The online learning environment facilitates exposure to global Fintech trends, enabling students to understand how different regions approach financial technology and innovation.

5. Hands-On Fintech Applications: Students engage in practical applications of Fintech concepts, including coding exercises, case studies, and projects that simulate real-world scenarios in the Fintech industry.

Course Duration for Online BBA-Fintech Management:

The duration of the Online BBA-Fintech Management program may vary depending on the institution and the mode of study (full-time or part-time). On average, the program can be completed in three to four years of full-time study.

The program's flexible structure allows students to study at their own pace, accommodating the needs of working professionals and individuals with other commitments. Some institutions may offer accelerated options, allowing students to complete the program in a shorter duration, while others may permit breaks between courses if needed.

Individuals considering the Online BBA-Fintech Management program should consult with the institution to understand the specific course duration options and any flexibility in study arrangements

Academic Fees for Online BBA-Fintech Management:

The academic fees for the Online BBA-Fintech Management program vary depending on the institution offering the program and the mode of study (full-time or part-time). Students are advised to check with the specific institution for the most accurate and up-to-date information on fees.

Typically, the fees for the program include tuition fees, registration fees, and any additional charges for study materials or online learning platforms. Some institutions may offer financial aid or scholarships to eligible students pursuing a degree in Fintech Management. Exploring these options and inquiring about any available funding opportunities is recommended.

Applicants should also consider other costs, such as textbooks, technology requirements, and any additional expenses related to online learning, when planning for the academic fees associated with the Online BBA-Fintech Management program.

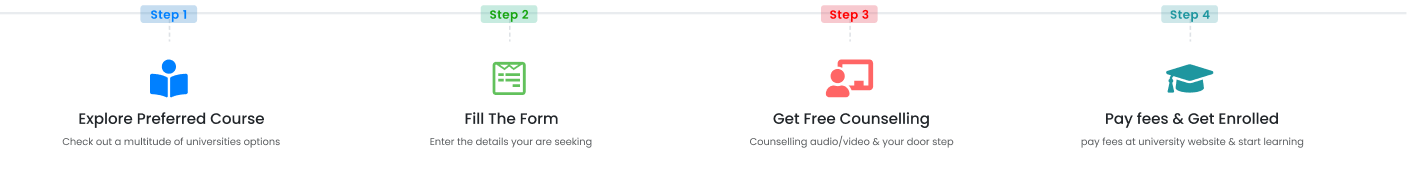

Admission Procedure for Online BBA-Fintech Management:

The admission procedure for the Online BBA-Fintech Management program may involve the following steps, although specific processes may vary by institution:

1. Research and Choose Institutions: Conduct research to identify institutions that offer the Online BBA-Fintech Management program. Consider factors such as accreditation, faculty expertise, and the relevance of the curriculum to the Fintech industry.

2. Check Admission Requirements: Review the admission requirements specified by the institutions of interest. These may include educational qualifications, technical proficiency, language proficiency, and other criteria relevant to Fintech Management.

3. Complete the Online Application: Once an institution is chosen, complete the online application form for the Online BBA-Fintech Management program. Ensure that all required information is accurately provided.

4. Application Fee: Some institutions may require an application fee to process applications. Pay the fee as per the instructions provided by the institution.

5. Submit Supporting Documents: Submit all required supporting documents, which may include transcripts, letters of recommendation, a personal statement highlighting interest in Fintech Management, and any other documents specified by the institution.

6. Interview or Assessment: Some institutions may conduct interviews or additional assessments to evaluate an applicant's suitability for the Fintech Management program.

7. Technical Requirements: As the program is delivered online, ensure that you meet the technical requirements specified by the institution, including having access to a reliable internet connection and a suitable device.

8. Await Admission Decision: After submitting the application and supporting documents, await the admission decision. This may take some time, so it is advisable to apply well in advance of the program start date.

9. Accept Offer and Enroll: If offered admission, carefully review the offer and any conditions attached. Accept the offer according to the institution's instructions and complete the enrollment process.

Prospective students should refer to the specific institution's website or contact the admissions office for detailed and accurate information on the admission procedure for the Online BBA-Fintech Management program.

Why Opt for Education Loan in BBA-Fintech Management:

Considering an education loan can be a strategic financial decision when pursuing your Online BBA-Fintech Management program. Here's why opting for an education loan is a prudent choice for financing your specialized degree:

1. Specialized Financial Assistance: Education loans are tailored to cover the unique costs associated with a Fintech Management program, including tuition fees, specialized study materials, and other relevant expenses specific to the Fintech industry. This targeted financial support ensures that you can invest in a high-quality education in the rapidly evolving field of Fintech.

2. Tailored Repayment Plans: Education loans often come with flexible repayment options, allowing you to choose a plan that aligns with your financial situation. Whether you opt to start repaying after completing your studies or prefer installment-based repayments, the flexibility ensures that you can manage your finances strategically, considering the potential career advancements within the Fintech sector.

3. Credit History Building: Responsibly managing and repaying your education loan contributes positively to your credit history. This can be advantageous when engaging in future financial transactions, such as applying for additional loans or participating in financial activities relevant to roles in Fintech management.

4. Uninterrupted Focus on Fintech Studies: By securing an education loan, you can concentrate on your studies without immediate financial concerns. This allows you to fully immerse yourself in the specialized coursework, including coding for finance, blockchain applications, and other crucial elements of Fintech Management.

5. Investment in Fintech Career: Pursuing an Online BBA-Fintech Management program is an investment in your future Fintech career. An education loan ensures that you have the necessary financial backing to make the most of your academic journey, potentially including participation in internships or projects relevant to Fintech analysis.

It is essential to thoroughly understand the terms and conditions of the education loan, including interest rates, repayment options, and any associated fees. Conducting a comprehensive comparison of available loan options and seeking financial advice can empower you to make an informed decision specific to financing your specialized education in Fintech Management.

Is Online BBA-Fintech Management Worth It?

The value of an Online BBA-Fintech Management degree depends on individual circumstances and career objectives. Several factors contribute to determining whether the specialized degree is worth pursuing for you:

1. Fintech Career Advancement: An Online BBA-Fintech Management degree can significantly enhance your qualifications and pave the way for diverse career opportunities within the Fintech industry. If you are aiming for career advancement or contemplating a shift into the Fintech sector, this specialized degree can provide a distinct advantage.

2. In-Depth Fintech Knowledge: Pursuing an Online BBA-Fintech Management degree offers a deep dive into the intricacies of Financial Technology. If you have a passion for understanding blockchain, digital banking, cybersecurity, and other Fintech innovations, the degree can be highly rewarding in terms of specialized knowledge.

3. Industry-Relevant Skills: The skills cultivated through the program, such as coding for finance, blockchain applications, and data analytics in a financial context, are directly applicable to the Fintech industry. This makes graduates well-equipped for roles demanding a fusion of financial expertise and technological acumen.

4. Global Perspectives in Fintech: The online learning environment facilitates exposure to global Fintech trends, allowing you to understand how different regions approach financial technology and innovation. This global perspective can be advantageous in the interconnected world of Fintech.

5. Networking Opportunities in Fintech: Online BBA-Fintech Management programs often provide networking opportunities through virtual discussions, forums, and collaborations with peers and industry professionals. Building a network within the Fintech community can prove invaluable for future career prospects and business connections.

6. Personal Circumstances and Aspirations: Consider your personal circumstances, financial resources, time availability, and career aspirations within the Fintech domain. If you align with the specialized focus of the Online BBA-Fintech Management program and it resonates with your professional goals, the degree is likely to be a worthwhile investment.

Ultimately, the value of an Online BBA-Fintech Management degree lies in how effectively you leverage it to achieve your Fintech-related aspirations. Conduct thorough research, select a reputable institution, and weigh the benefits against the costs to make an informed decision tailored to your Fintech career objectives.

Examination Pattern for BBA-Fintech Management:

The examination pattern for Online BBA-Fintech Management is designed to evaluate students' comprehension of specialized Fintech concepts and their ability to apply this knowledge in real-world scenarios. Here is an overview of the typical examination pattern:

1. Specialized Exam Formats: Exams in the Fintech Management program may encompass various formats, such as case studies, coding assessments, scenario-based questions, and theoretical examinations. The diverse formats aim to assess different dimensions of Fintech knowledge and skills.

2. Coding Assessments: Given the technological focus of Fintech Management, coding assessments may be part of the examination pattern. These assessments evaluate students' proficiency in coding languages relevant to Fintech, emphasizing practical application.

3. Case Studies in Fintech: Case studies present real-world Fintech scenarios, requiring students to analyze situations, identify challenges, and propose innovative solutions. This format assesses critical thinking and problem-solving skills in the context of Fintech.

4. Theoretical Assessments: Traditional theoretical assessments may cover foundational concepts in Fintech, including blockchain technology, digital banking, cybersecurity, and financial innovations. These assessments evaluate students' understanding of theoretical frameworks in the Fintech landscape.

5. Online Exam Platforms: Exams are typically conducted through secure online platforms that facilitate a controlled environment for students. The platforms may include features for monitoring, ensuring academic integrity throughout the examination process.

6. Exam Duration and Flexibility: The duration of exams may vary based on the complexity of the questions and the format. Some exams may be time-bound, while others may offer flexibility within a specified timeframe. The structure allows students to showcase their understanding without unnecessary time constraints.

7. Continuous Assessment: Some Fintech Management courses may incorporate continuous assessment methods, such as quizzes, projects, and discussions, alongside traditional exams. This approach ensures a comprehensive evaluation of students' performance and engagement with the course material.

8. Practical Demonstrations: In addition to written assessments, practical demonstrations or projects may be part of the examination pattern. These demonstrations assess students' ability to apply theoretical knowledge to real-world Fintech scenarios.

9. Feedback and Grading: Following the completion of exams, instructors or examiners provide constructive feedback to guide students' learning. Grading is based on the demonstrated understanding of Fintech concepts, practical skills, and critical thinking abilities.

It is essential for students to familiarize themselves with the specific examination policies and guidelines provided by the institution offering the Online BBA-Fintech Management program. This includes understanding the assessment formats, technical requirements, and any additional instructions to ensure a smooth examination experience.

Course Curriculum

| semester | subjects |

| 1 | Principles of Management, Financial Accounting, Microeconomics, Business Communication |

| 2 | Marketing Management, Organizational Behavior, Macroeconomics, Business Ethics |

| 3 | Operations Management, Human Resource Management, Fintech Foundations, Entrepreneurship |

| 4 | Blockchain Technology, Financial Data Analytics, Digital Banking, Internship |

| 5 | Cryptocurrencies and Smart Contracts, Fintech Regulation and Compliance, Cybersecurity in Finance, Elective 1 (e.g., Peer-to-Peer Lending) |

| 6 | Strategic Management in Fintech, International Business, Fintech Project Management, Internship |

Duration of Specialization

3 Years

Eligibility Criteria

Requirements for Online BBA-Fintech Management:

To enroll in the Online BBA-Fintech Management program, applicants typically need to meet certain requirements, including:

1. Educational Background: A high school diploma or its equivalent is generally required. Some institutions may consider applicants with relevant work experience or prior learning assessments.

2. Technical Proficiency: Given the technology-focused nature of the program, applicants may be required to demonstrate proficiency in certain technical skills or undergo assessments related to technology and coding.

3. Language Proficiency: Since the program is conducted in English, applicants may need to demonstrate proficiency in the English language through standardized tests .

4. Application Process: Applicants are usually required to complete an online application form and submit supporting documents, such as transcripts, letters of recommendation, and a personal statement expressing their interest in Fintech Management.

5. Interview or Assessment: Some institutions may conduct interviews or additional assessments to evaluate an applicant's suitability for the Fintech Management program.

6. Technical Requirements: As the program is delivered online, applicants must ensure they have access to a reliable internet connection and a computer or device capable of running the required software for Fintech-related coursework.

It's important for applicants to review the specific admission criteria of the institution offering the Online BBA-Fintech Management program to ensure they meet all requirements.

Skills Developed in Online BBA-Fintech Management:

The Online BBA-Fintech Management program equips students with a diverse skill set that is highly relevant to the Fintech industry. Key skills developed through the program include:

1. Blockchain Technology: Understanding the principles of blockchain and its applications in financial transactions and digital currencies.

2. Coding for Finance: Proficiency in coding languages relevant to Fintech, enabling students to develop and implement financial technology solutions.

3. Cybersecurity: Knowledge of cybersecurity measures to protect financial systems and data in the digital environment.

4. Data Analytics in Finance: Analytical skills to interpret and leverage data for making informed financial decisions and enhancing business processes.

5. Digital Banking: Understanding the principles and practices of digital banking, including mobile banking, online transactions, and financial technology in banking operations.

6. Financial Innovation: Exploring innovative financial products, services, and business models that leverage technology for improved efficiency and customer experience.

7. Risk Management in Fintech: Evaluating and mitigating risks associated with financial technology, considering regulatory compliance and industry standards.

8. Financial Decision-Making: Applying quantitative analysis and financial modeling to make strategic decisions in a Fintech context.

admission procedure

Job Opportunities

Job Opportunities in Fintech Management:

Graduating with an Online BBA-Fintech Management degree opens up a spectrum of job opportunities within the dynamic and evolving Fintech industry. The specialized nature of the degree equips graduates with skills highly sought after by Fintech employers. Potential job opportunities include:

1. Blockchain Developer: Work on developing and implementing blockchain solutions for financial transactions, smart contracts, and secure digital identities.

2. Fintech Analyst: Analyze market trends, assess the viability of Fintech innovations, and provide strategic insights to businesses seeking to adopt new technologies.

3. Digital Banking Specialist: Contribute to the development and enhancement of digital banking platforms, ensuring seamless and secure online financial services.

4. Cryptocurrency Analyst: Evaluate and analyze digital currencies, assess market trends, and provide insights into the potential impacts of cryptocurrencies on the financial landscape.

5. Cybersecurity Specialist in Fintech: Focus on protecting financial systems and data from cyber threats, ensuring the security and integrity of Fintech operations.

6. Data Scientist in Finance: Utilize data analytics to extract meaningful insights from financial data, contributing to data-driven decision-making in Fintech organizations.

7. Fintech Entrepreneur: Leverage the knowledge gained in Fintech Management to start and manage your venture, exploring innovative solutions and disrupting traditional financial paradigms.

It's important to note that the Fintech industry is diverse, and roles may span various domains, including finance, technology, and entrepreneurship. Graduates should actively engage in networking, internships, and continuous learning to enhance their readiness for the dynamic Fintech job market.

Top Recruiters

Top Recruiters in Fintech Management:

Graduates with an Online BBA-Fintech Management degree are highly sought after by leading employers in the Fintech sector. Here are some top recruiters who value the specialized skills and knowledge acquired through a Fintech Management program:

1. Fintech Startups: Emerging Fintech startups often seek graduates with a blend of financial expertise and technological acumen to drive innovation in the sector.

2. Blockchain Companies: Organizations specializing in blockchain technology value Fintech Management graduates for their understanding of blockchain applications in finance and beyond.

3. Digital Banking Platforms: Companies offering digital banking solutions recruit graduates to contribute to the evolution of online banking, mobile payments, and other digital financial services.

4. Fintech Consulting Firms: Consulting firms with a focus on Fintech and financial innovation seek graduates to provide strategic advice and insights to clients navigating the evolving landscape.

5. Cryptocurrency Exchanges: Platforms dealing with digital currencies often recruit Fintech Management graduates for roles involving cryptocurrency analysis, market trends, and regulatory compliance.

6. Traditional Financial Institutions: Established financial institutions recognize the value of Fintech expertise and may hire graduates to bridge the gap between traditional finance and innovative technologies.

7. Technology Companies in Finance: Tech giants involved in financial services or developing financial technology solutions seek Fintech Management graduates to contribute to their Fintech initiatives.

Graduates are encouraged to actively participate in career development activities, internships, and networking opportunities to enhance their visibility and appeal to potential employers within the dynamic Fintech sector.